Fidelity solo 401k calculator

In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

Solo 401k Contribution Calculator Solo 401k

Fidelity Workplace Can Help Manage Your Employees Benefits.

. A Smarter Way To Save For Healthcare Expenses. Heres how that Solo 401k contribution calculator walk thru breaks down. The Planning Guidance Center helps make it easy to get a holistic view of your financial plan from one place.

You only pay taxes on. Get Help Rolling Over Your Old 401k Account to a Fidelity IRA. Solo 401 k Contribution Calculator.

Ad Bank Account included with our 199 LLC formation. Conveniently access your Fidelity workplace benefits such as 401k savings plans stock options health savings accounts and health insurance. Small business 401k plans with big benefits.

A Fidelity Solo 401K allows you to contribute up to 57000 per year an additional 6500 in catch-up contributions are allowed for those over 50. 19000 employee salary deferral contribution. Ad An All-In-One Benefits.

The employee calculation for a Solo 401k is pretty straightforward. Penelope makes it simple. A 401 k match is an employers percentage match of a participating employees contribution to their 401 k plan usually up to a certain limit denoted as a percentage of the employees.

If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under. Just like a traditional 401K you. Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans.

With the Solo 401k you can contribute 47936. I would imagine that the process for contributing to a Solo 401k would be pretty much the same with any company but be aware that this post is geared specifically towards. Please note that this calculator is only intended for sole proprietors or LLCs taxed as such.

Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation. Ad An All-In-One Benefits Solution That Can Help You Save Time Streamline Services. Second many employers provide.

You can invest up to. Ad Attract and keep employees with 401k plans. If your business is an S-corp C-corp or LLC taxed as such.

With this tool you can see how prepared you may be for retirement review and. Use the Contribution Calculator to see the. Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings.

When you make a pre-tax contribution to your. A Fidelity Solo 401K allows you to contribute up to 57000 per year an additional 6500 in catch-up contributions are allowed for those over 50. Form your Wyoming LLC with simplicity privacy low fees asset protection.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA.

First all contributions and earnings to your Solo 401k are tax-deferred. The highlight of the self-employed 401 k is the ability to contribute to the plan in two ways. To determine your Solo 401k maximum take Employee Contribution Employer Contribution.

Get Help Rolling Over Your Old 401k Account to a Fidelity IRA. 1 Your salary deferral amount must be in accordance with your 401k Salary Reduction Agreement election made prior to your plan year-end. Ad TIAA HSA Allows You to Save Pay For Qualified Medical Expenses Now And In The Future.

First all contributions and earnings to your 401 k are tax-deferred. 2 If you are age 50 or older or will turn. According to 2022 IRS 401 k and Profit-Sharing Plan Contribution Limits as an employee you.

A Solo 401k can be one of the best tools for the self-employed to create a secure retirement. Affordable easy payroll integrated. You only pay taxes on contributions and earnings when the money is withdrawn.

401 K Savings Guidance Chart Saving For Retirement 401k Chart Finance Education

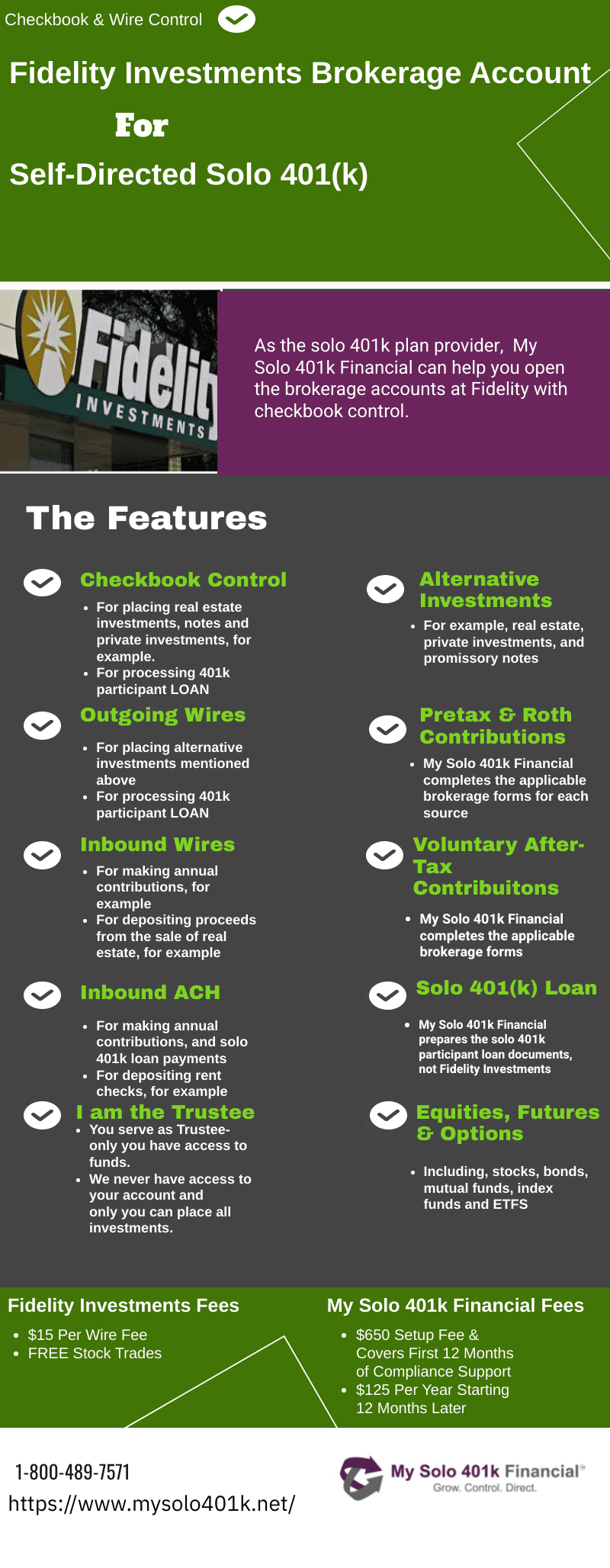

Fidelity Solo 401k Brokerage Account From My Solo 401k

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Rules For Your Self Employed Retirement Plan

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Who Are Leased Employees Are They Eligible For My 401 K Plan

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

After Tax 401 K Contributions Retirement Benefits Fidelity

Roth 401k Roth Vs Traditional 401k Fidelity

401 K Plan What Is A 401 K And How Does It Work

What Compensation Should We Use To Calculate Company Contributions To Our 401 K Plan

Solo 401k Contribution Calculator Solo 401k

Solo 401k Contribution Calculator Solo 401k

Solo 401k Contribution For Partnership And Compensation